Which of the Following Properly Describes the Accounting for Goodwill

School University of Texas Dallas. Calculate the amount of deferred consideration to be recognised at 31 March 20X6 and explain how the unwinding of any.

C2 1 Learning Objectives 1 Usefulness Of An Account 2 Characteristics Of An Account 3 Analyzing And Summarizi Learning Objectives Financial Analysis Learning

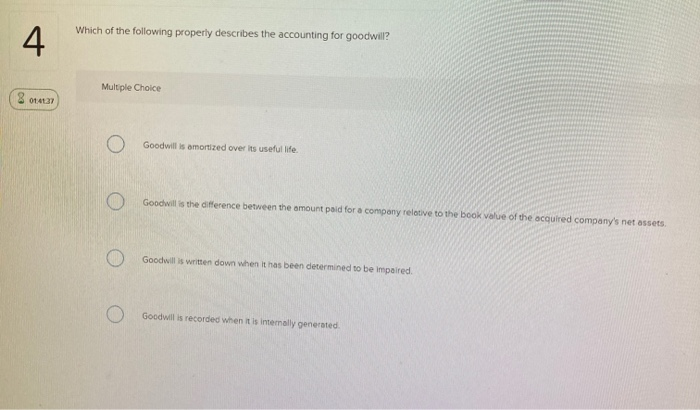

Which of the following properly describes the accounting for goodwill.

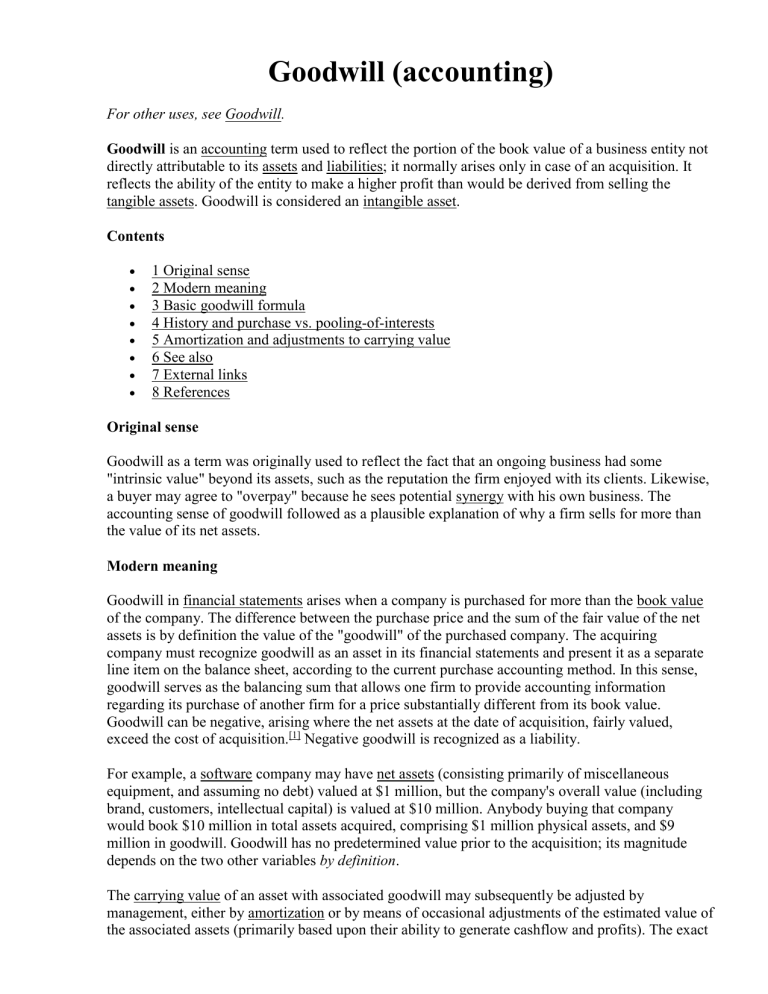

. Goodwill weighted average profit x years of acquisition Goodwill 235000 x 8 29375. Is the correct answer as per IAS 38 Intangible assets goodwill is not amortized instead tested for the impairment each year under IAS 36 impairment of Assets. In accounting the goodwill is recorded when a firm.

Which of the following accurately describes the appropriate accounting for goodwill acquired through a business combination. Goodwill is written down when it has been determined to be. Goodwill is recorded when it is internally generated.

Which of the following properly describes the accou A. Which of the following properly describes the. View Ch8 Poll9png from ACCT 2010 at The Hong Kong University of Science and Technology.

Goodwill is amortized over its expected useful life not to exceed 20 years. Goodwill is amortized over its useful life. Goodwill is tested for impairment whenever impairment indicators are present.

Learn vocabulary terms and more with flashcards games and other study tools. Which of the following properly describes the accounting for goodwill A. Start studying Accounting chapter 7.

This preview shows page 7 - 10 out of 27 pagespreview shows page 7 - 10 out of 27 pages. Goodwill is amortized over its useful life. Use the capitalization method to evaluate goodwill.

Which cost is not recorded as part of the cost of a building. G accounting for goodwil. Goodwill is stated as the excess of the purchase price over the fair market value of identifiable net assets acquired in a purchase transaction.

Oodwill is created when it is internally generated. Use the following steps to. Goodwill is tested for.

Course Title ACCT 2301. Ratings 100 2 2 out of 2 people found this document helpful. Goodwill is amortized over its useful life.

Which of the following properly describes the accounting for goodwill. Goodwill is amortized over its useful life. Goodwill is recorded when it is internally generated.

The amount of goodwill recognized on a consolidated balance sheet will always be the same when accounting for a business combination under either the acquisition method or the. Goodwill is recorded when it is internally generated. Patricia Libby Robert Libby Rent Buy.

Financial Accounting with Connect Plus 8th Edition Edit edition 80 4759 ratings for this. Which of the following properly describes the accounting for goodwill. Goodwill is amortized over its useful life.

Which of the following properly describes the accounting for goodwill. Goodwill is recorded when it is internally generated. It should be recorded at cost and amortized over a 10-year.

Which of the following properly describes the accounting for goodwill. D Accumulated depreciation is a contra-asset account. Which of the following properly describes the accounting of goodwill.

An appropriate discount rate for use is 6. Which of the following correctly describes the nature of depreciation. Solution for Which of the following properly describes the accounting for goodwill.

In accounting goodwill is an intangible asset Intangible Assets According to the IFRS intangible assets are identifiable non-monetary assets without physical substance. Goodwill is created when it is internally generated. Multiple Choice Goodwill is amortized over its useful life.

C Accumulated depreciation is a contra-equity account.

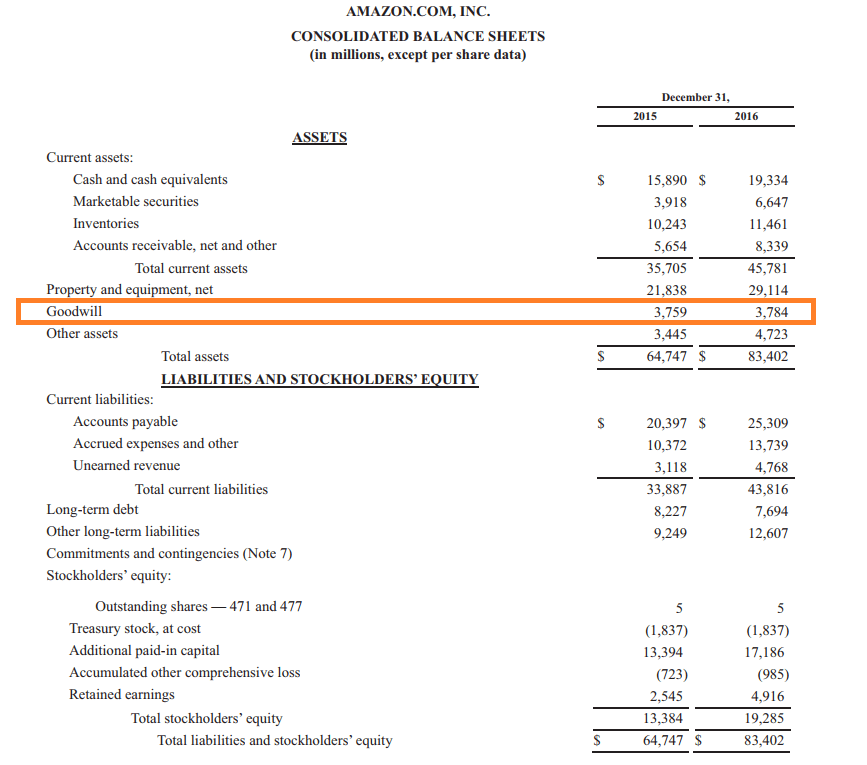

Goodwill Overview Examples How Goodwill Is Calculated

How Do Intangible Assets Show On A Balance Sheet

Solved Which Of The Following Properly Describes The Chegg Com

Comments

Post a Comment